The latest earnings report from Nvidia has once again fueled the ongoing debate about whether the AI hype will translate into sustained financial performance meeting Wall Street’s lofty expectations. Investors eagerly awaited the semiconductor giant’s earnings report as if it were a second Super Bowl, particularly given Goldman Sachs analysts’ bold proclamation dubbing it “the most important stock on planet earth.” CEO Jensen Huang and his team did not disappoint, delivering results that met or exceeded analysts’ optimistic forecasts.

Nvidia reported first-quarter revenues of $22.1 billion, marking a staggering 265% increase from the previous year, surpassing analysts’ consensus estimate of a 240% rise to $20.6 billion. Adjusted earnings per share also saw a remarkable surge, climbing 765% year-over-year to $5.15 per share, compared to the expected $4.64. Furthermore, gross margins, a critical profitability indicator, continued to rise, reaching 76.7% in the quarter amidst the AI boom.

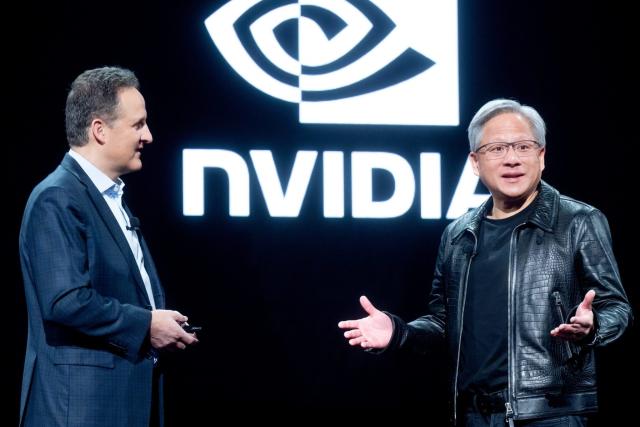

Following the earnings announcement, Nvidia shares experienced initial volatility in after-hours trading but ultimately surged over 10% by 5 p.m. ET as investors absorbed the impressive numbers. Huang, also a co-founder of Nvidia, emphasized that the earnings serve as evidence that “accelerated computing and generative AI have hit the tipping point,” highlighting the burgeoning demand across various companies, industries, and nations. He further pledged significant new product innovations in the upcoming year to drive industry progress.

Nvidia’s forward-looking guidance, closely monitored by Wall Street for insights into the AI landscape, exceeded expectations as well, with management forecasting revenues of $24 billion in the first quarter, compared to analysts’ projections of $22.5 billion.

Analysts reacted positively to Nvidia’s earnings performance, with Wedbush’s Dan Ives lauding Huang as “the Godfather of AI” and describing the moment as another significant milestone in the AI revolution. Gene Munster, a seasoned tech analyst and managing partner at Deepwater Asset Management, echoed this sentiment, suggesting that Nvidia’s success is just the beginning of multiple AI waves that will propel the company’s stock higher.

Prior to this strong earnings report, Nvidia shares had already played a significant role in the S&P 500’s performance, contributing to roughly 30% of the index’s gains so far this year. The company’s stock had surged approximately 40% year-to-date and an astonishing 1,585% over the past five years before the fourth-quarter earnings release, leading some to question the sustainability of such rapid growth.